Hotline:

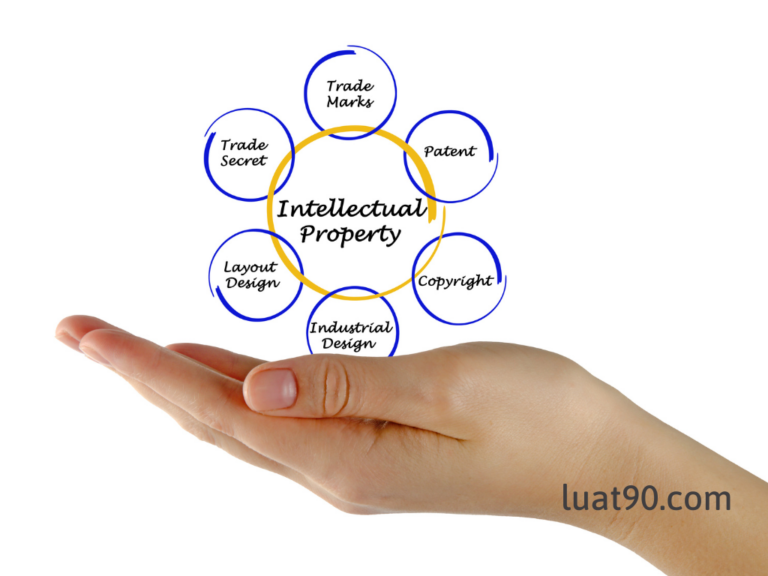

Methods of trademarks valuation in Vietnam. Trademark is a valuable asset to a business. In many cases, trademark valuation is necessary for business capital contribution, mergers và acquisitions, trademark assignment or licensing, and court proceedings in dispute settlement about trademarks, etc.

So, how many methods are there to value trademarks and how is each method implemented in Vietnam?

What is trademark valuation in Vietnam?

Trademark valuation is the determination of the monetary value of a trademark on the market at a certain place and time, for a certain purpose and carried out according to valuation standards.

Cases where trademark valuation is required in Vietnam?

Trademark valuation is required in the following cases:

– Inventory the assets of the corporation.

– Contribute capital to business by trademarks or participate in the division, separation, merger, consolidation, mergers and acquisitions of corporation.

– Use trademarks as collateral to borrow capital at a bank.

– Assign or license of trademark.

– For the dispute settlement of the Court.

– For liquidation in case the corporation is dissolved or bankrupt.

– Determine measures and costs to protect the trademark.

Vietnamese law on trademarks valuation

The legal provisions on trademark valuation are in the following documents: Law on Price, decrees guiding the Law on Price, system of Vietnam’s valuation standards, etc.

Accordingly, Valuation Standard No.13 on valuation of intangible assets issued under Circular No. 06/2014/TT-BTC dated January 7, 2014 of the Ministry of Finance is considered the most important document because it stipulates the grounds in determining the value of intellectual property in general and the trademark in particular.

Trademark valuation service is a conditional business service. Organizations that want to provide this service must sastify the conditions for establishment and operation in accordance with the laws of Vietnam.

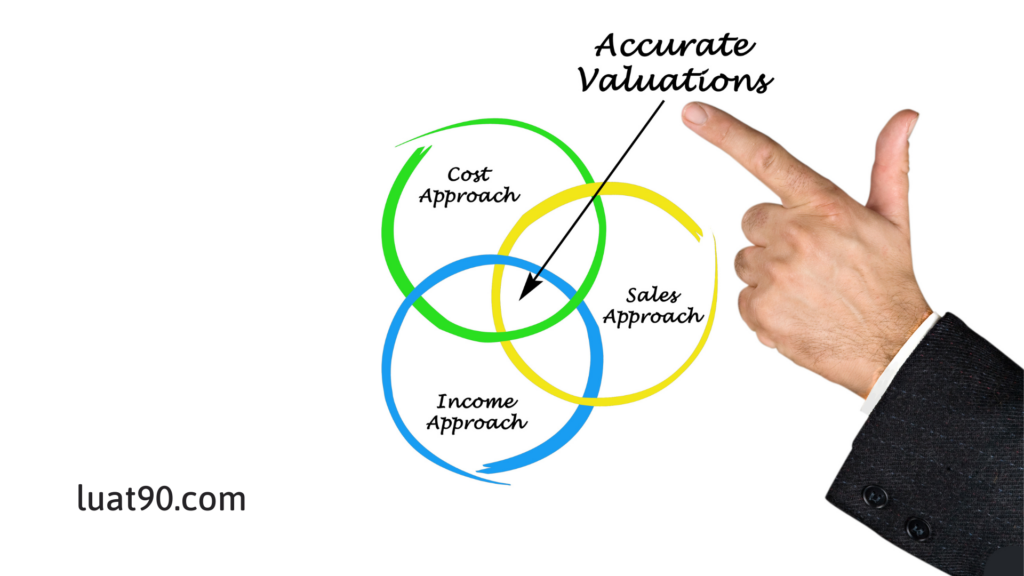

Methods of trademarks valuation in Vietnam

Methods of trademark valuation in Vietnam are specified in the Valuation Standard No. 13 on valuation of intangible assets issued under Circular No. 06/2014/TT-BTC dated January 7, 2014 of the Ministry of Finance.

Accordingly, methods of trademark valuation in Vietnam include: based on market, based on cost and based on income. Within each approach are many different valuation methods. Based on the time of valuation, the purpose of valuation, the information and data about the property that can be collected, the valuator will choose the most appropriate valuation approach.

1/ Based on market

The value of the intellectual property is determined based on the comparison and analysis of information of similar intangible assets with transaction prices on the market. The valuator uses at least 03 similar intellectual property for comparison. This method can also be used in addition to other methods.

The advantage of this method is that it uses market data and information, so the valuation results are considered the best. The disadvantage of this method is that each intellectual property transaction is unique, so it is almost difficult to find a similar agreement that can serve as a basis for valuation.

2/ Based on cost

Valuation based on cost estimates the value of an intellectual property based on the cost of recreating the intellectual property right as a prototype with the asset to be valued or the replacement cost of creating an similar intellectual property with the same functions and uses at current market prices.

Estimated Value of Intellectual Property = Renewable Cost (Replacement Cost) – Accumulated Depreciation + Manufacturer’s Profit (where, the manufacturer’s profit is determined through comparative, investigative, survey measures)

Valuation based on cost consists of two main methods: the renewable cost method and the alternative cost method.

– Renewable cost method: The renewable cost method determines the value of an intellectual property right by calculating the cost of creating another asset similar to the intellectual property right at current market price.

– Replacement cost method: The replacement cost method determines the value of an intellectual property right by calculating the cost of replacing that asset with another asset with similar functions and uses at current market price.

3/ Based on income

Valuation based on income determines the value of intellectual property through the present value of the income, cash flows, and cost savings brought about by intellectual property. This method focuses on the estimated income that the holder of intellectual property expects to receive during the validity period of the intellectual property right. Valuation based on income consists of three main methods: the method of income from using intellectual property, the method of excess profit, and the method of additional income.

– Method of income from using intellectual property:

The value of intellectual property is calculated on the basis of the present value of cash flows using intellectual property rights that the owner receive when license them. This method assumes that organizations or individuals that do not own the intellectual property must pay to use it. Therefore, this method calculates the value of intellectual property by calculating the amount of money saved if the organization or individual owns the intellectual property. This method is implemented by discounting the future cash flows as the saved amount for using intellectual property rights, tax deducted (if any).

– Method of excess profit:

This method determines the value of intellectual property on the basis of the difference between the profits earned by a corporation when using and not using this intellectual property. In the method of excess profit, the value of the intellectual property is estimated on the basis of the difference of the present values of the two cash flows where the intellectual property is used to generate excess income for the owner and in case the owner does not use the intellectual property.

– Method of additional income:

This method determines the value of the intellectual property through the present value of the cash flows arising from the contribution of the intellectual property after removing cash flows arising from the contribution of other assets (tangible assets, financial assets).

Is dossier required for trademarks valuation in Vietnam?

Dossier which is required for trademarks valuation in Vietnam includes:

– Written request for valuation.

– Protection titles for intellectual property rights are established on the basis of registration or documents proving ownership of various types of intellectual property rights that are not required to be registered. – Other documents related to the subject of valuation.

Bạn cần tư vấn? Đừng ngần ngại liên hệ ngay với chúng tôi để được hỗ trợ.