Hotline:

Distribution of inheritive property without a will in Vietnam

Inheritance is the transfer of property ownership of a deceased person to a living person, inheritance includes inheritance according to will and inheritance according to law. In principle, in case the deceased does not leave a will, the legal inheritance will apply.

Inheritance right without a will in Vietnam

In case the deceased does not leave a will, the property will be distributed according to the provisions of law, called inheritance according to law.

In addition, inheritance according to law also applies in cases where, although there is a will, the will is not legal; or the testamentary heirs have died before or at the same time as the testator, or have had no right to inherit, or have refused to receive the estate; or the organization which is testamentary heir, no longer exists at the time of the death of the testator.

Inheritance according to the law also applies to the part of property that the deceased did not dispose of in the will, property related to the illegal part of the will, property related to the testamentary heirs but they do not have the right to inherit, or refuse to receive the estate, or die before or at the same time as the testator or the organization which is testamentary heir, no longer exists at the time of the death of the testator.

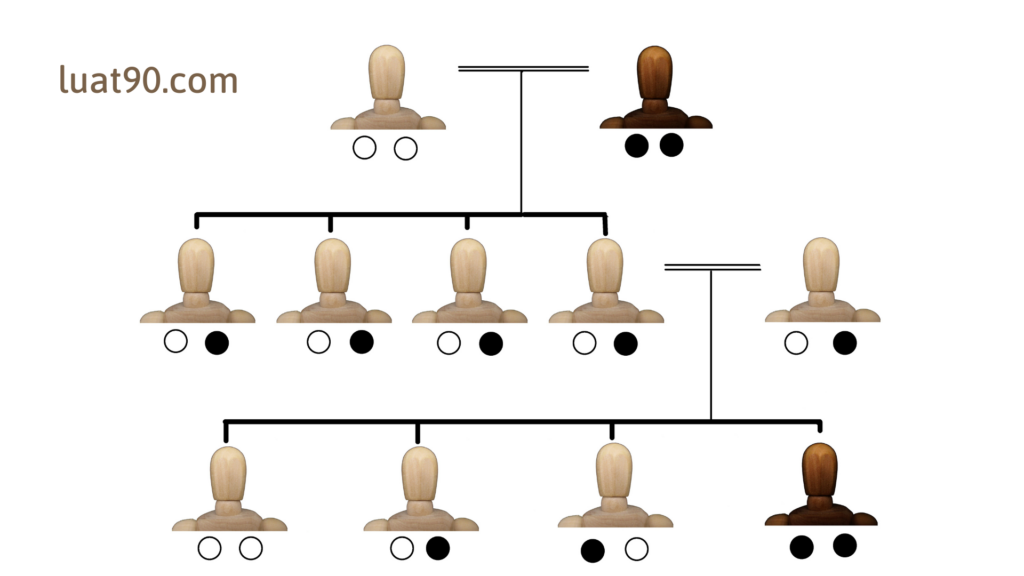

Order of priority of inheritance in Vietnam when there is no will

1. The first level of heirs comprises: spouses, biological parents, adoptive parents, offspring and adopted children of the deceased.

2. The second level of heirs comprises: grandparents and siblings of the deceased; and biological grandchildren of the deceased.

3. The third level of heirs comprises: biological great-grandparents of the deceased, biological uncles and aunts of the deceased and biological nephews and nieces of the deceased.

Note:

– If a stepchild and his or her stepparents care for and support each other as though they were biologically related, they may inherit each other’s estates.

– Where a wife and husband have divided their multiple ownership property while they are still married and one of them subsequently dies, the surviving spouse shall still be entitled to inherit the estate of the deceased.

– Where a wife and husband have applied for but not yet obtained a legally effective divorce pursuant to a judgment or decision of a court, or they have obtained such a divorce but the judgment or decision of the court is not yet effective, and one of them dies, the surviving spouse shall, nevertheless, be entitled to inherit the estate of the deceased.

– A person who is the wife or husband of the deceased at the time when his or her spouse dies shall be entitled to inherit the estate of the deceased even if that person subsequently remarries.

Heirs at Vietnamese law

Determine the heirs in accordance with the law of Vietnam

If an heir is an individual, such person must be alive at the time of commencement of the inheritance or, if such person is born and alive after the commencement of inheritance, must have been conceived prior to the time when the deceased dies. Where an heir under a will is a body or organization, it must be in existence at the time of commencement of the inheritance

If the heir under the will can be an individual or an organization, the heir at law can only be an individual.

If persons entitled to inherit each other’s property die at the same time, they cannot inherit each other’s property. In this case, each person’s assets will be divided among the remaining heirs of that person, except for the case of succeeding heirs described in the next section of this article.

Persons not entitled to inherit in Vietnam

The following persons are not entitled to inherit:

– Persons convicted of having intentionally caused the death of or harmed the health of the deceased, of having seriously mistreated or tortured the deceased, or of having harmed the honor or dignity of the deceased;

– Persons having seriously breached their duty to support the deceased;

– Persons convicted of having intentionally caused the death of another heir in order to obtain all or part of the entitlement of such other heir to the estate;

– Persons deceiving, coercing or obstructing the deceased with respect to the making of the will, or forging, altering or destroying the will in order to obtain all or part of the estate contrary to the wishes of the deceased.

The persons above may, nevertheless, inherit the estate if the deceased was aware of such acts but, nevertheless, allowed them to inherit the estate under the will.

Succeeding heirs in accordance with the law of Vietnam

According to the law, the heir must be the person who was still alive at the time of the death of the person leaving the estate. If the heir is a child and dies before or at the same time as the parent who leaves the estate, the issue of succeeding heirs is raised.

Where a child of a testator died prior to or at the same time as the testator, the grandchildren of the testator shall inherit that part of the estate which their father or mother would have been entitled to inherit had such father or mother still been alive. If the grandchildren also died prior to or at the same time as the testator, the great-grandchildren of the testator shall inherit that part of the estate which their father or mother would have been entitled to inherit had such father or mother still been alive.

Distribution of estates in accordance with the law of Vietnam

Principles of distribution of estates in accordance with the law of Vietnam

1. Inheritance will be divided equally among the people of the same level of heirs.

2. Only those in the first level of heirscan inherit. If no one in the first level of heirsis eligible to inherit, the people in the second level of heirswill inherit. If there is no one in the first level of heirs and the second level of heirsare eligible to inherit, then the people in the third level of heirs are entitled to inherit.

3. The heirs have the right to demand the estate to be distributed in kind. If the estate is not able to be equally distributed in kind, the heirs may agree that the property shall be valued and may agree on which heirs shall be entitled to receive which particular items of property. Failing such agreement, the assets in kind shall be sold for distribution.

4. Where a new heir appears after an estate has been distributed, the estate shall not be re-distributed in kind but the heirs which have received [a share of] the estate must pay the new heir a sum equivalent to the share of the estate of such [new heir] at the time of distribution of the estate in proportion to the [respective] share of the estate already received [by each heir], unless otherwise agreed.

5. Where the right of an heir to inherit is disallowed after an estate has been distributed, such heir must return the inheritance or pay to the other heirs a sum equivalent to the value of the inheritance received at the time of distribution of the estate, unless otherwise agreed

Postponement of division of inheritance in Vietnam

The division of the deceased’s inheritance shall be suspended in some of the following cases:

1. Where the heirs agree, that an estate is to be distributed only after a certain period of time, it shall be distributed only after such period of time has expired.

2. If there is a request to distribute an estate but such distribution will seriously and adversely affect the life of the remaining wife or husband and family, such spouse has the right to request a court to fix the share of the estate to which other heirs are entitled but not to allow distribution of the estate during a certain period of time. Such period shall not exceed three years from the date of commencement of inheritance. When such period fixed by the court has expired or such remaining spouse has remarried, the other heirs have the right to request the court to permit distribution of the estate.

The prescriptive period with respect to a claim of an heir for distribution of an estate in Vietnam

1. The prescriptive period with respect to a claim of an heir for distribution of an estate shall be thirty years regarding immovable property or ten years regarding movable property from the time of commencement of the inheritance. Upon the expiry date of the aforesaid period, the estate shall belong to the estate administrator.

2. The prescriptive period with respect to a claim of an heir for a declaration of right of inheritance of the requester or to disallow the claim to inheritance of another shall be ten years from the time of commencement of the inheritance.

3. The prescriptive period with respect to a claim for an heir to fulfill property obligations of the deceased shall be three years from the time of commencement of the inheritance.

Bạn cần tư vấn? Đừng ngần ngại liên hệ ngay với chúng tôi để được hỗ trợ.